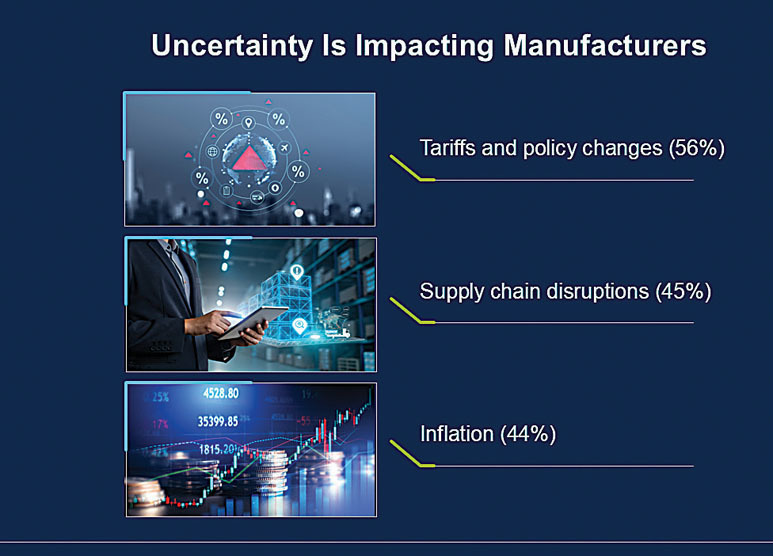

Tariffs. Geopolitical tensions. Inflation. The skills gap. And the list goes on. The manufacturing industry is facing a host of headwinds at the midpoint of this decade, but not all is gloom and doom. When speaking with customers, Jason Walker, vice president, general manufacturing practice at Hexagon’s Manufacturing Intelligence div., said tariffs are obviously a big concern, but half are optimistic that it’s going to have a positive impact on their businesses. The company is based in North Kingstown, Rhode Island, and he is in the U.K.

“2025 State of Manufacturing Report”

“2025 State of Manufacturing Report”

He added that the manufacturers the company is speaking with express optimism, and that can equate to a resurgence for U.S. manufacturing. “Often with optimism comes action, because if you’re optimistic you may invest in a new piece of equipment or technology that is going to help take your business forward, and it becomes a self-fulfilling prophecy to some extent.”

In addition to managing production costs, tariffs present the challenge of how to address the skills gap, Walker noted. “If tariffs result in less parts being imported and more onshoring of businesses, there is going to be an increased need for new skills to come into the workforce, because we know the industry as a whole is already suffering from the skills shortage, and battling to transfer the tribal knowledge — that most of the skilled operators on the shop floor have — onto new operators, as well as attract those new operators.”

While many manufacturers have wanted to onshore more production for many years, Russ Bukowski, president of CAD/CAM software developer Mastercam in Tolland, Connecticut, concurred that the challenge has always been attracting reliable talent in the U.S. to take on manufacturing jobs, and education plays a critical role. “One of the challenges that Mastercam is focused on overcoming along with the rest of the manufacturing industry is ushering in that next generation of manufacturing leaders by providing education software, educational curriculum and partnering with events like the WorldSkills competition.”

When it comes to skilled labor for the aerospace sector, the pipeline specifically for new engineering talent is under a lot of stress, emphasized Richard Aboulafia, managing director for AeroDynamic Advisory LLC, a boutique aerospace consulting firm based in Ann Arbor, Michigan. “The supply of skilled labor is limited and fungible. Machinists’ jobs tend to be a little less mobile. Engineers tend to move.”

Hexagon reports that the perception is reshoring is a quick fix, but the reality is that it takes one to three years or more to reshore operations, and that nearly a third of manufacturing professionals expect labor shortages to slow or limit reshoring. Hexagon

Hexagon reports that the perception is reshoring is a quick fix, but the reality is that it takes one to three years or more to reshore operations, and that nearly a third of manufacturing professionals expect labor shortages to slow or limit reshoring. Hexagon

While poaching talent from other companies is not an ideal or even favored tactic, Aboulafia adds that it inevitably happens, though an alternative is available. “The most forward working suppliers I’ve seen are the ones who say, ‘We are creating our people.’ ”

Therefore, training is needed to help fill the gap, which he said he witnesses while visiting factories, especially in small towns, which tend to have workforces more open to the idea of training. “We see tremendous opportunities to train these folks and give them good jobs. In other words, increase the labor force.”

Automation marches on

As manufacturing automation incrementally increases to boost productivity, the type of training changes to suit the skills needed for each job. For example, aerospace companies are no longer training people to manually drill holes. Instead, they’re teaching software programming to those who operate the machines and robots being utilized to drill holes, Aboulafia said. “There are few major tectonic shifts. I’ve been in the industry for 37 years, very gradually it has become quieter and less populated.”

Of course, some level of human intervention is still required in most manufacturing processes, especially since automated manufacturing systems are not necessarily as efficient or cost-effective as desired, said Hexagon’s Walker. Nonetheless, technologies are being introduced to automate many tedious, mundane processes that skilled workers perform, reducing their burden and enabling them to do more value-added activities.

For example, Hexagon’s Robotic division launched the Aeon humanoid robot this year to help meet customer needs and address labor shortages. According to the company, the robot combines Hexagon’s sensor suite with advanced locomotion, artificial intelligence-driven mission control and spatial intelligence to deliver agility, versatility and awareness.

Aeon is initially targeted to perform tedious tasks such as picking and placing materials, and sorting and transporting parts, but Walker said the expectation is that the complexity of tasks will increase over time. In addition, declining birth rates are occurring in China, Europe and the U.S. “We’re already struggling for skills in manufacturing, and if we have less and less people being born, that’s only going to be exacerbating it more. We’re excited to see when humanoid robots will be in place working alongside a skilled operator.”

Bukowski pointed out that Mastercam’s core market is small to midsize enterprises, where robots augment workers’ capabilities, such as moving pallets on and off of machines, but not replacing workers.

Since the start of the decade, manufacturers have invested in more automation systems to expand capabilities and capacity rather than adding headcount, he added. “It puts us in a good position in the CAD/CAM industry for 2026 as more companies are going to be looking at automating workflows, and that’s where a lot of tools in Mastercam really come into play, like advanced simulation so they can identify and reduce issues before they happen on the shop floor, minimizing errors and downtime.”

Technological barricade

A lack of modern technology is becoming a major roadblock to attracting the next generation of workers, according to Hexagon’s “2025 America’s State of Manufacturing” report, which is based on a survey of 500 U.S. manufacturing professionals. The report states that 72% of manufacturers say outdated technology is actively preventing them from attracting and retaining workers.

Walker pointed out that many digital tools are available to streamline operations, but a lot of manufacturing operations are still paper-based. “You can’t manage what you don’t measure. If all of these operations are manual and they’re very paper-based, there’s no way to get real-time insight into what’s happening.”

In addition, the documentation process might not be accurate enough to spot where process inefficiencies are, he noted. That level of inaccuracy can cause issues even when a manufacturer has a strategy to drive continuous improvement. “If you’re not tracking everything that’s happening across your workflow, across your value chain, it’s difficult to identify where the problem areas are; where do we need to focus on actively for continuous improvement.”

The report states: “We’ve been talking about digital transformation in manufacturing for nearly two decades and many factories still aren’t there. The reason isn’t a lack of awareness; it’s a hesitancy to truly invest in people and drive meaningful change. Until manufacturers close the gap between the technology workers use at home and what they encounter on the job, recruiting and retaining digitally native talent will remain a major challenge.”

One technology many are familiar with is generative AI. However, Mastercam’s Bukowski noted that the large language models used for AI are non-deterministic, meaning that someone can ask the same question three times and likely receive three different answers.

For AI to provide repeatable results there must first be a large bank of “true manufacturing” data, such as speeds and feeds, and toolpath optimization strategies, Bukowski said. To achieve that, industry must partner with customers and show them the benefits of collecting this data on a large scale. “But the way it is today, it’s a little difficult because there’s not enough big data in manufacturing because a lot of customers are protecting their intellectual property, and rightly so.”

As a result, the next generation of AI in manufacturing will require a more open conversation with manufacturers to emphasize the benefit in sharing this data, bringing a manufacturer’s data into a private AI cloud that only the manufacturer can mine or bringing it into a larger system that can be mined for all customers, he explained. “The real future of AI is getting hands-on data from these different manufacturing companies to bring into a model so that we can create some repeatability in the number of results we get from it.”

Walker added that he sees the application of AI coming into real-world use cases for manufacturers to help them streamline and enhance efficiency. “With the addition of AI tools that we’ve launched, we’ve seen a reduction in the time it takes to prepare a part for machining by 75%. That means the business can get to producing parts rather than just preparing for producing them.”

With a significant amount of business for CAD/CAM software, especially from the medical, defense and aerospace sectors, Bukowski said demand will grow during this year’s final quarter and the first quarter of next year. “I do feel like 2026 is going to start off with a strong push.”

The worst-case scenario from a trade war does not appear likely, Aboulafia said, but the risk of a recession and the impact of inflation remain concerns. “Probably the biggest national issue is inflation, which is creeping up and will probably creep up further.”

Nonetheless, the commercial and military aerospace markets are robust, he added. “It looks like we’re in the middle of a very strong cycle, and you have big production delays, which means backlogs. That guarantees at least a couple of other great years.”

Related Glossary Terms

- arbor

arbor

Shaft used for rotary support in machining applications. In grinding, the spindle for mounting the wheel; in milling and other cutting operations, the shaft for mounting the cutter.

- toolpath( cutter path)

toolpath( cutter path)

2-D or 3-D path generated by program code or a CAM system and followed by tool when machining a part.