The way end users purchase drills, endmills, taps, inserts, saw blades, abrasives, and other items is changing and will continue to evolve between now and the year 2003. Large-volume purchasers of cutting tools, such as General Motors, Ford, Pratt & Whitney, Boeing, and Caterpillar are propelling the changes. And, according to many purchasing experts, what’s happening in the automotive and aerospace industries today will trickle down to smaller manufacturers and job shops during the next five years.

Transaction costs have become extremely important. Whether it’s a Chrysler engine plant in Kenosha, WI, or a small job shop in Poughkeepsie, NY, end users everywhere want to reduce product-acquisition costs. They want to keep tooling costs from interfering with the bottom line and focus on their core competencies.

"The objective of strategic buying is to take cost and time out of the supply chain," says Phil Carter, director of the Center for Advanced Purchasing Studies at the National Association of Purchasing Management (NAPM), Tempe, AZ. "More and more buyers are upgrading their purchasing skills."

In many companies, purchasing is now viewed as a strategic weapon in the war on cost reduction. "In the past, we were typically at the bottom of the food chain," recalls a purchasing executive at a large aerospace manufacturer. Today, purchasing is viewed with respect, especially when it comes to reducing cost and adding value.

"There’s an emphasis and understanding by top management that purchasing can have a positive effect on the bottom line," notes Bethany Heinrich, purchasing-staff administrator, Honda of America Mfg. Inc., Marysville, OH. "Purchasing now assumes a leadership role in working with engineering and suppliers."

Supplier Reduction

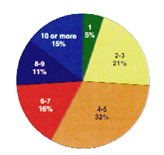

Fig. 1: Number of cutting tool suppliers used by end users.

Fig. 2: Future demand for cutting tool suppliers.According to a recent survey conducted by CUTTING TOOL ENGINEERING Magazine, most end users rely on a handful of suppliers (Figure 1). Nearly one-third (32%) of respondents say they use four or five different suppliers. In fact, 5% of the individuals responding claim they rely on just one supplier, while 15% said they use 10 or more cutting tool vendors.

Within the next five years, however, these figures should change dramatically. By 2003, at least one-fourth of end users will be relying on a smaller vendor base. "Lean supply chains will be a competitive advantage," claims NAPM’s Carter. Within five years, he believes very few end users will use more than six or seven cutting tool vendors, with most companies paring their preferred suppliers to just three or four companies.

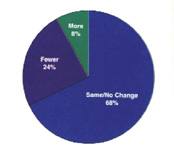

The cutting tool industry is already beginning to see some evidence of this trend (Figure 2). Only 8% of the survey respondents expect to increase their supplier base during the next 12 months, while three times as many people (24%) claim they will be using fewer vendors.

"My company is narrowing tool vendors down to one supply house," claims a mechanical engineer at a large engine manufacturer in Indiana. "Any and all tooling purchases will be made through the one formally selected as our sole supplier. If we choose Kennametal, they will buy tooling from other vendors for us."

"There’s definitely a trend toward supplier-base reduction and partnerships," says Carter. "Companies are working on developing more complex, tighter relationships with those companies to achieve joint cost savings."

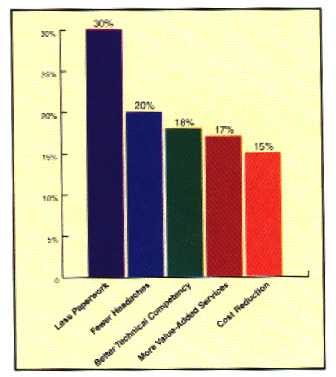

Fig. 3: Perceived benefits of using fewer cutting tool suppliers.

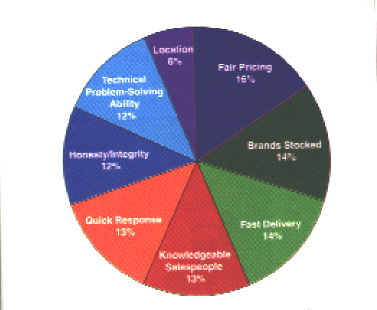

Fig. 4: Factors that determine purchasing decisions.

Fig. 5: What end users look for.By consolidating vendors, end users hope to improve productivity. Survey respondents believe less paperwork is the biggest benefit that comes from using fewer suppliers (Figure 3), which translates into fewer headaches and better technical competency.

More than two-thirds (72%) of respondents also claim they have purchased cutting tools directly from a manufacturer. When coupled with vendor-reduction trends, that spells further woes for local distributors, who will have to reinvent themselves through value-added service.

Buying Factors

Quality is the leading factor that determines from which suppliers end users purchase cutting tools (Figure 4). Indeed, two-fifths (40%) of respondents claim that quality is the most important criteria for vendor selection, followed by service (32%) and price (28%). End users are becoming much more demanding in what they expect from suppliers, and this trend will continue during the next five years.

Of the CTE survey respondents, 40% believe American manufacturers produce the best cutting tools in the world, compared to 36% who chose Europe and 24% who favor Asia. When asked to rate the quality of the world’s three main cutting tool producing regions (Europe, North America, and Southeast Asia) on a 1-4 scale (1 = poor; 4 = excellent), North American (primarily United States) products earned a 3.5.

Surprisingly, European (primarily German and Swedish) cutting tools--often touted for their superior quality--did not rank as high as U.S. tools. They did come in a close second, however, with a 3.1 rating, while Southeast Asian (primarily Japanese and Korean) products earned an average quality score of 2.0.

When choosing a cutting tool supplier, end users consider fair pricing, fast delivery, and brand selection (Figure 5). Pricing was cited by 16% of the respondents, while delivery (14%) and brands (14%) followed close behind. Other important considerations include quick response (13%), honesty/integrity (12%), and technical problem-solving ability (12%).

Electronic Commerce

Only 10% of the survey respondents claim they have purchased cutting tools via computer. However, within five years, that figure should change dramatically as electronic commerce becomes more widely accepted.

According to Forrester Research Inc., Cambridge, MA, U.S. companies will exchange $17 billion in goods and services via the Internet this year. However, within four years, business-to-business e-commerce is expected to explode into a $327-billion industry. One reason behind this whopping increase is purely economic: Doing business via the Internet typically results in cost savings of about 5% to 10% of sales.

"E-commerce will have a huge impact on the purchasing community," predicts NAPM’s Carter. "In fact, this will be the biggest change of all. It will automate a lot of paperwork; purchase orders and requisition writing will disappear. Most ordering will be done using electronic catalogs.

"The need for speed in decision-making and the need to increase the velocity of product and service fulfillment are driving this trend," adds Carter. "Once security issues are fully addressed, purchasing transactions will explode on the Internet. The Internet will affect the supply chain even more radically than the interstate highway’s impact on the transportation industry."

That optimism is hard to fathom today, especially when you consider that only 3% of the CTE survey respondents said they are currently looking for electronic-ordering capability. Obviously, manufacturers need to do a better job educating the marketplace on the economic benefits of e-commerce.

Vendor Evaluation

Slightly more than one-third (35%) of respondents have a formal program in place to evaluate cutting tool suppliers. The majority (58%) of end users say they evaluate vendors by job or application, while one-third (33%) review their suppliers on an annual basis. Only 9% conduct evaluations monthly or quarterly.

Industry observers claim vendor evaluation is an excellent way to seek improvements and build long-term relationships. For instance, Honda’s Heinrich says her company considers its monthly performance measures, which track quality and delivery, to be a strategic tool.

When the company shares performance data with its suppliers, everyone understands what the measures are and what they mean. "With performance measures, there should be no surprises," Heinrich points out.

Problems and Concerns

End users want competent sales

people and are very concerned about what they believe is a serious knowledge gap. When posed the question, "How can cutting tool suppliers do a better job serving your needs?" 21% of respondents answered "competent salespeople" . And, when end users were asked to identify their biggest problem or concern with cutting tool salespeople, 14% said they "lack market and industry knowledge."

The following three comments typify this frustration:

"Too many tool companies place too much emphasis on hiring a degreed salesperson," claims an automotive-parts supplier in Pennsylvania. "I’d rather purchase from salespeople who have machined a lot themselves."

"We need people who know the process of metalcutting," adds a gear manufacturer in Pennsylvania. "I’ve told suppliers, ÔIf [the salespeople] are not from a shop or engineering background, don’t bother to send them out to see me.’"

"There is an influx of young people who have never gotten their hands dirty," laments a small-job-shop owner in Ohio. "They do not have hands-on training and lack basic knowledge. I recently had someone who was trying to sell me a Swiss-type screw machine, but did not recognize an Acme Davenport or a Beckler. There are few people who understand relief angles, correction factors, and basic machine operations."

Survey respondents pinpointed specific gripes about cutting tool salespeople. For instance, many end users said salespeople over-promise (14% of respondents) and fail to offer solutions (13%). The respondents claim that salespeople fail to listen (11%), are slow to deliver (11%), don’t follow up after a sale (10%), and are over-aggressive (10%).

There are several other areas where end users believe salespeople need to improve. For example, 7% of respondents said salespeople "don’t cost-justify price increases" and 4% believe they "lack cost-management skills." Despite those concerns, there’s a glimmer of optimism: Just 3% of respondents claim that salespeople "focus only on price."

Speaking of price, cost control is another hot-button topic among 15% of the end users responding to the CTE survey. "Cutting tool suppliers need to identify cost drivers of doing business with a customer--both internal and external devices," says an engine manufacturer in Wisconsin. "These figure into the total cost analysis."

Other end users want cutting tool suppliers to address customer-service issues, such as technical problem-solving (18% of respondents) and just-in-time delivery (12%). "Although customer service is talked about a lot, it is often overlooked," claims a large auto-parts manufacturer in California. "It is very difficult to find good tool suppliers who follow up on orders or have basic knowledge."

"As just-in-time delivery and the desire to limit work in progress escalates, cutting tool delivery must improve," warns the owner of a job shop in Michigan.

Despite much recent hype on integrated supply (IS), only 3% of respondents claim they are interested in such programs. However, 9% of the end users said they want distributors to stock more products, which is somewhat compatible with the IS concept whereby an outside firm takes over all the acquisition responsibilities for an entire plant.

About the Authors

David Ridenour is national sales manager for Tapmatic Corp., Post Falls, ID. Peter Matysiak is president of Emuge Corp., Northborough, MA.

Related Glossary Terms

- inner diameter ( ID)

inner diameter ( ID)

Dimension that defines the inside diameter of a cavity or hole. See OD, outer diameter.

- just-in-time ( JIT)

just-in-time ( JIT)

Philosophy based on identifying, then removing, impediments to productivity. Applies to machining processes, inventory control, rejects, changeover time and other elements affecting production.

- metalcutting ( material cutting)

metalcutting ( material cutting)

Any machining process used to part metal or other material or give a workpiece a new configuration. Conventionally applies to machining operations in which a cutting tool mechanically removes material in the form of chips; applies to any process in which metal or material is removed to create new shapes. See metalforming.

- relief

relief

Space provided behind the cutting edges to prevent rubbing. Sometimes called primary relief. Secondary relief provides additional space behind primary relief. Relief on end teeth is axial relief; relief on side teeth is peripheral relief.

- sawing machine ( saw)

sawing machine ( saw)

Machine designed to use a serrated-tooth blade to cut metal or other material. Comes in a wide variety of styles but takes one of four basic forms: hacksaw (a simple, rugged machine that uses a reciprocating motion to part metal or other material); cold or circular saw (powers a circular blade that cuts structural materials); bandsaw (runs an endless band; the two basic types are cutoff and contour band machines, which cut intricate contours and shapes); and abrasive cutoff saw (similar in appearance to the cold saw, but uses an abrasive disc that rotates at high speeds rather than a blade with serrated teeth).