With the U.S. economy booming, metalcutting shops everywhere are working harder than ever to keep up with demand. Sales of new machine tools are skyrocketing, cutting tool consumption is setting records, and many shops are running around the clock. On the surface, this appears to be a wonderful time to be involved in the industry. But, in reality, it also is a very challenging era.

According to a recent survey conducted by CUTTING TOOL

ENGINEERING Magazine, more than three-fourths (78%) of respondents believe that it’s harder to remain competitive today than it was five years ago. If you share this sentiment, welcome to the brave new world of cutting tools.

Finding, training, and retaining qualified workers rank as the biggest headaches facing the metalcutting industry. In fact, human resource issues account for almost 70% of the challenges that end users must confront today.

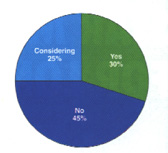

Figure 1: Biggest end-user challenges. |

Many shop owners and managers are scrambling to find skilled labor to program and operate their machines. A lack of qualified workers (35% of respondents) is the most serious threat to success (Figure 1). Other staffing issues that keep people awake at night include employee training (15% of respondents), health insurance (10%), and labor costs (9%).

Competition from domestic (12%) and foreign (11%) sources also rank as major challenges facing shop owners and managers. There’s tremendous pressure to retain existing customers while at the same time develop new accounts. During the next five years, the top goal for many respondents is to attract new business. One way they intend to accomplish that goal is through more aggressive marketing efforts, such as direct mail, radio advertising, electronic commerce, and telemarketing.

Customer Focus

Many shops also will be focusing more attention on meeting and exceeding customer needs. As in other industries, the customer is king in today’s metalcutting market. Almost one out of every two respondents (47%) claim customer satisfaction is more important than employee satisfaction (33%) or shareholder satisfaction (20%).

Customer retention also is one of the biggest concerns among respondents. So it’s no surprise that improving responsiveness to customer needs and improving customer relations are two of the most important goals that shop owners and managers will be working on during the next five years.

|

|

One-third (34%) of respondents claim they have formed strategic alliances or partnerships with customers during the last 12 months. In addition, 21% said they are considering this type of marketing strategy.

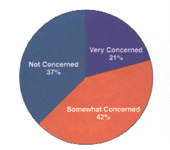

Strategic alliances and partnerships are important for supplier relations, as well. More than one-quarter (30%) of respondents have recently formed such agreements with suppliers, while 25% are considering this option (Figure 2). As more mergers and acquisitions reduce the number of cutting tool manufacturers and distributors, supplier alliances and partnerships will play a critical role in assuring consistent service and support.

Speaking of industry consolidation, many end users are worried about this trend and expect to see it continue. On the survey, 21% of respondents say they are "very concerned" and 42% say they are "somewhat concerned" about industry consolidation (Figure 3). However, one-third (37%) claim they are not concerned by this widespread phenomenon.

Regardless of their opinion about the trend, almost all the respondents (94%) believe consolidation will continue to occur in the cutting tool industry during the next five years.

New Technology

More than one-fourth (27%) of the respondents plan to grow their companies by investing in new metalcutting machines and tools. High-speed machining and dry machining are expected to become more popular manufacturing methods, but end users have mixed emotions on how this new technology will affect their shops.

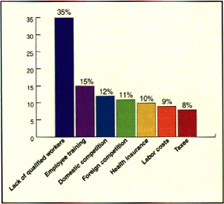

Figure 4: Future of high-speed maching. |

Almost three-fourths (72%) of respondents believe high-speed machining will grow in importance during the next five years. Specifically, 25% claim this new metalcutting process will have a major impact on their shops, while 47% say high-speed machining will have some impact (Figure 4). More than one-quarter (28%) are more skeptical and don’t believe high-speed machining will have an affect on their operations.

Concern over cost will prevent many end users from investing in high-speed machines during the next five years. Indeed, 43% of respondents say the high-speed price tag would be hard for them to cost justify. An additional 37% point out that a lack of applications would be another reason not to shell out the extra cash.

Only 9% of end users express concern over the performance of high-speed cutting tools. Other factors that will keep people from investing in high-speed machining include employee training concerns (5%), and questions about safety (3%) and the reliability of motors and spindles (3%).

Two out of-three (63%) end users also believe dry machining will become more common during the next five years. However, 37% predict cutting fluid and coolant will still be widely used in their shops as the new millennium begins.

Bullish Outlook

If the majority of survey respondents are correct, the U.S. economy will remain healthy for several more years. More than half (63%) of the end users surveyed by CTE are optimistic that favorable economic conditions will continue during the next three years. A small number (11%) expect the early 21st century economy will be worse than today, while 26% say they aren’t sure how the future economic picture will develop.

|

TOP FIVE END-USER GOALS 1. Attract new business. HOW END USERS PLAN TO GROW 1. Invest in new machines and tools. |

Needless to say, a healthy economy will be important to future growth in the metalcutting industry. As mentioned above, one-quarter (27%) of respondents plan to grow their companies in the next five years by investing in new machines and tools.

Obviously, most shop owners and managers view equipment as their most valuable asset. However, many executives also value their employees, because training will play an important role in future growth strategies according to 19% of the respondents.

Many shops also intend to grow by investing more heavily in computer technology to achieve a competitive advantage. Those companies want to adapt their operations to technology that gives them information about the marketplace. By harnessing the computer as a strategic tool, it’s possible to efficiently process data.

Metalcutting companies will need that business intelligence in order to attract new customers, which 17% of shop owners and managers claim will be their top goal during the next five years. Other important goals include reducing operating costs (15% of respondents), improving quality (14%), simplifying operations (12%), and improving responsiveness to customer needs (12%). Reducing cycle times (10%), improving customer relations (10%), and retaining employees (10%) also will keep top management busy well into the new century.

Future Fears

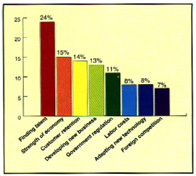

Figure 5: What end user fear about the future. Figure 5: What end user fear about the future. |

Finding new talent is what one out of every four (24%) survey respondents fears most about the brave new world unfolding around them (Figure 5). Other end user concerns include the economy (15%), new business development (13%), and government regulation (11%). And, in case you have more hair to pull out after all that, there’s labor costs (8% of respondents), new technology implementation (8%), and foreign competition (7%) to worry about.

Time management is the biggest personal challenge faced by end users today, according to 20% of the respondents. Balancing work and family (18%) ranks close behind, followed by managing change (15%) and strategic planning (13%). Other personal challenges include handling stress (12%), financial management (9%), and career management (6%). More than one-half (62%) of the survey respondents claim to work for a family-owned company that has been in business for an average of 34 years.

The information glut created by a convergence of new communication technology, such as the Internet, e-mail, and fax machines, was cited by 7% of respondents. There’s a tremendous amount of information for shop owners and managers to process today, but less time than ever to analyze it all.

Related Glossary Terms

- coolant

coolant

Fluid that reduces temperature buildup at the tool/workpiece interface during machining. Normally takes the form of a liquid such as soluble or chemical mixtures (semisynthetic, synthetic) but can be pressurized air or other gas. Because of water’s ability to absorb great quantities of heat, it is widely used as a coolant and vehicle for various cutting compounds, with the water-to-compound ratio varying with the machining task. See cutting fluid; semisynthetic cutting fluid; soluble-oil cutting fluid; synthetic cutting fluid.

- cutting fluid

cutting fluid

Liquid used to improve workpiece machinability, enhance tool life, flush out chips and machining debris, and cool the workpiece and tool. Three basic types are: straight oils; soluble oils, which emulsify in water; and synthetic fluids, which are water-based chemical solutions having no oil. See coolant; semisynthetic cutting fluid; soluble-oil cutting fluid; synthetic cutting fluid.

- metalcutting ( material cutting)

metalcutting ( material cutting)

Any machining process used to part metal or other material or give a workpiece a new configuration. Conventionally applies to machining operations in which a cutting tool mechanically removes material in the form of chips; applies to any process in which metal or material is removed to create new shapes. See metalforming.