Article from Future Market Insights

Global demand for toolholders, specifically arising from the automotive and defense and aerospace industries, will witness a relatively steady growth through 2028, as predicted by Future Market Insights (FMI) in its recently released market intelligence report. While the demand for toolholders will be largely driven by emerging economies, in particular the manufacturing sector, China is likely to make substantial investments in high-performance cutting tools, considering the robust manufacturing and industrial output in the region.

In other developing countries such as Philippines and Bangladesh, the positive scenario and policies, infrastructure and steps that are being taken to promote business, especially the manufacturing sector, will have a positive impact on the toolholders market offering huge opportunities for investors.

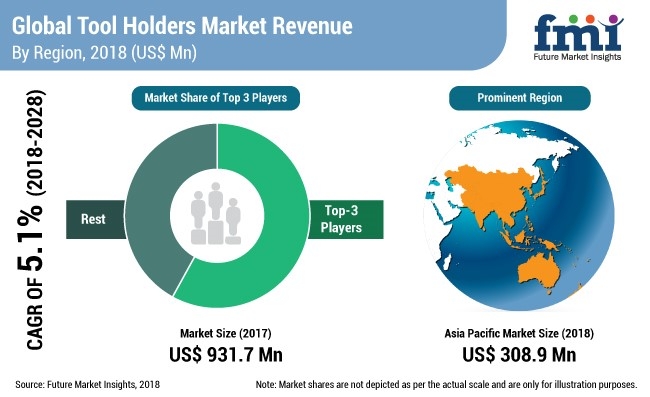

As per the report, the global toolholders market will top US$ 1 billion by 2019. Moreover, growing demand for high-precision products with increased output capacity is propelling the demand for advance toolholders in the global market, opines FMI.

Key Market Insights at a Glance:

- The demand for toolholders is anticipated to grow at a moderate pace over the forecast period.

- Asia Pacific is estimated to hold a prominent share of the global toolholders market.

- Initiatives by regional governments are likely to encourage the movement of low-cost manufacturing towards parts of South-East Asia, thereby creating healthy growth prospects create healthy growth opportunities in Asia Pacific region.

- China will remain the largest consumer of machine tools, followed by U.S.

- The toolholders market is consolidated with Tier 1 players accounting for significant shares.

- The top three players of the market are estimated to account for more than a 50% market share.

- On the basis of types of toolholder, hydraulic toolholders segment is slated to remain a high-value, high-growth segment.

- In terms of end-use, general machining and fabrication and the automotive industries are likely to push maximum revenue into the toolholders market. The two end-use industries are estimated to collectively account for around 47% value share in the global toolholders market.

- BT flange taper will remain the most preferred taper type among CNC end users, in terms of volume and value, given its high degree of accuracy and precision, in any high-speed machining operations.

Laser Cutting Technologies Could Restrict Toolholders Sales

Laser cutting, a streamlined and precision manufacturing process, is likely to pose challenges for toolholders given its ability to not just cut materials but also apply finish to a product. Apart from lower risks of material deformation or warping, because there is no direcbt contact between the material and the laser cutting device, chances of incorrect markings and contamination further reduces. Although laser cutting could be technically challenging and costly, end-use industries demanding high cutting precision such as automotive, are projected to replace traditional tool cutting equipment. However, high market penetration of relatively low cost toolholders may restrict the demand for new and more advanced toolholders despite their high accuracy and ease of handling.

Takeaways from Competitive Landscape Analysis

- In a moderately consolidated landscape, Tier-1 companies such as Kennametal Inc., Sandvik Coromant Co. and BIG DAISHOWA Group among others hold approximately 55% to 65% market share.

- Tier-2 companies, on the other hand, hold nearly 35% to 45% market share. Such companies include Guhring Inc., Ceratizit Group, Kyocera Unimerco A/S, Kemmler Precision Tools GmbH and Haimer GmbH among others.

- Key players are projected to focus on enhancing product quality by implementing new technologies, tough and long-lasting equipment and consumables materials with added features at a competitive price.

- Top companies are also looking to target major manufacturing industries such as metal fabrication and automotive by offering high cutting accuracy with increased productivity.

For more information on this report, visit www.futuremarketinsights.com/reports/tool-holders-market.

Related Glossary Terms

- computer numerical control ( CNC)

computer numerical control ( CNC)

Microprocessor-based controller dedicated to a machine tool that permits the creation or modification of parts. Programmed numerical control activates the machine’s servos and spindle drives and controls the various machining operations. See DNC, direct numerical control; NC, numerical control.

- toolholder

toolholder

Secures a cutting tool during a machining operation. Basic types include block, cartridge, chuck, collet, fixed, modular, quick-change and rotating.