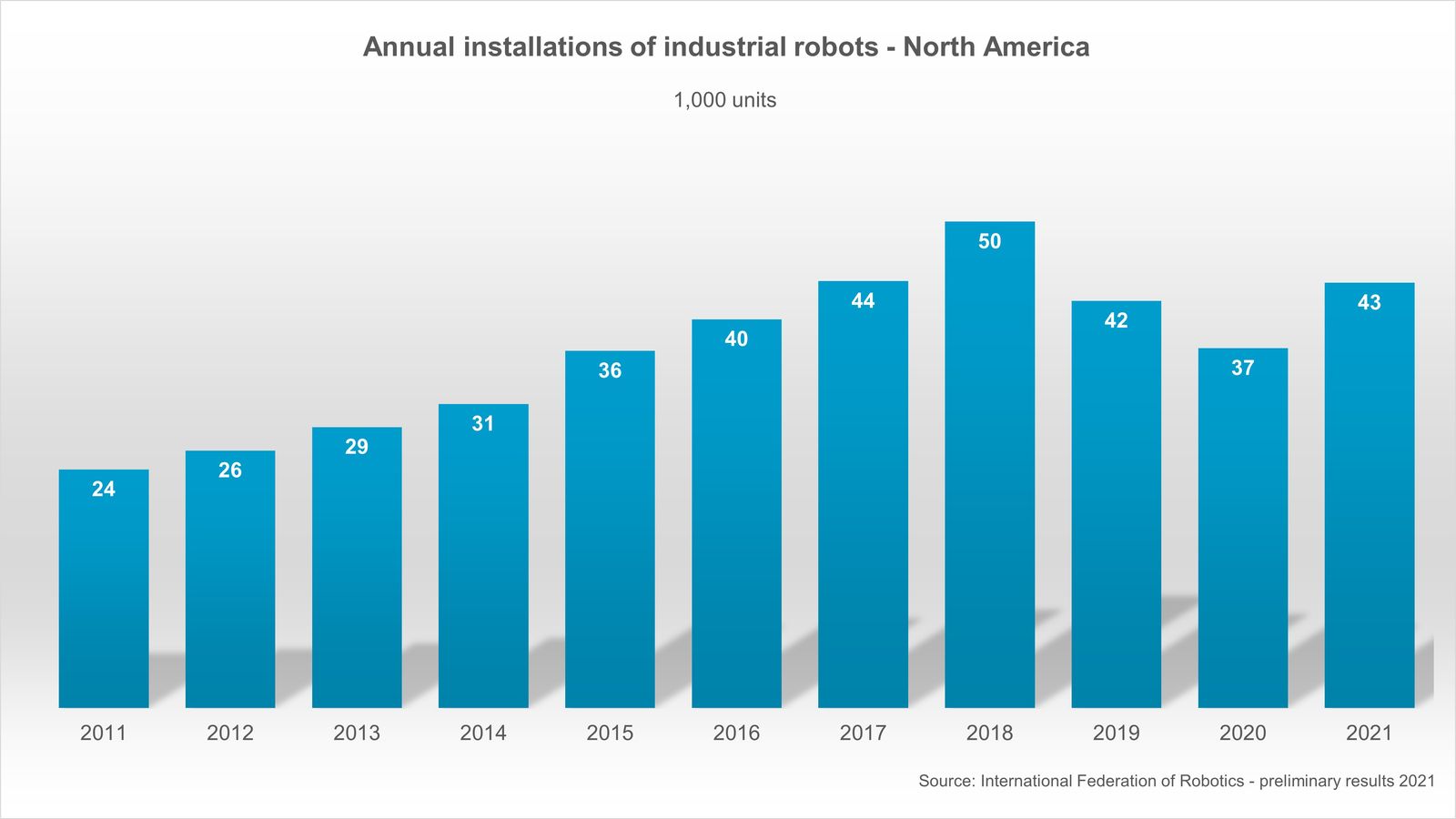

The North American robotics market experienced its best quarter ever to begin the year. Companies from the US, Canada, and Mexico ordered 11,595 industrial robots – up 28% compared to the first quarter of 2021.

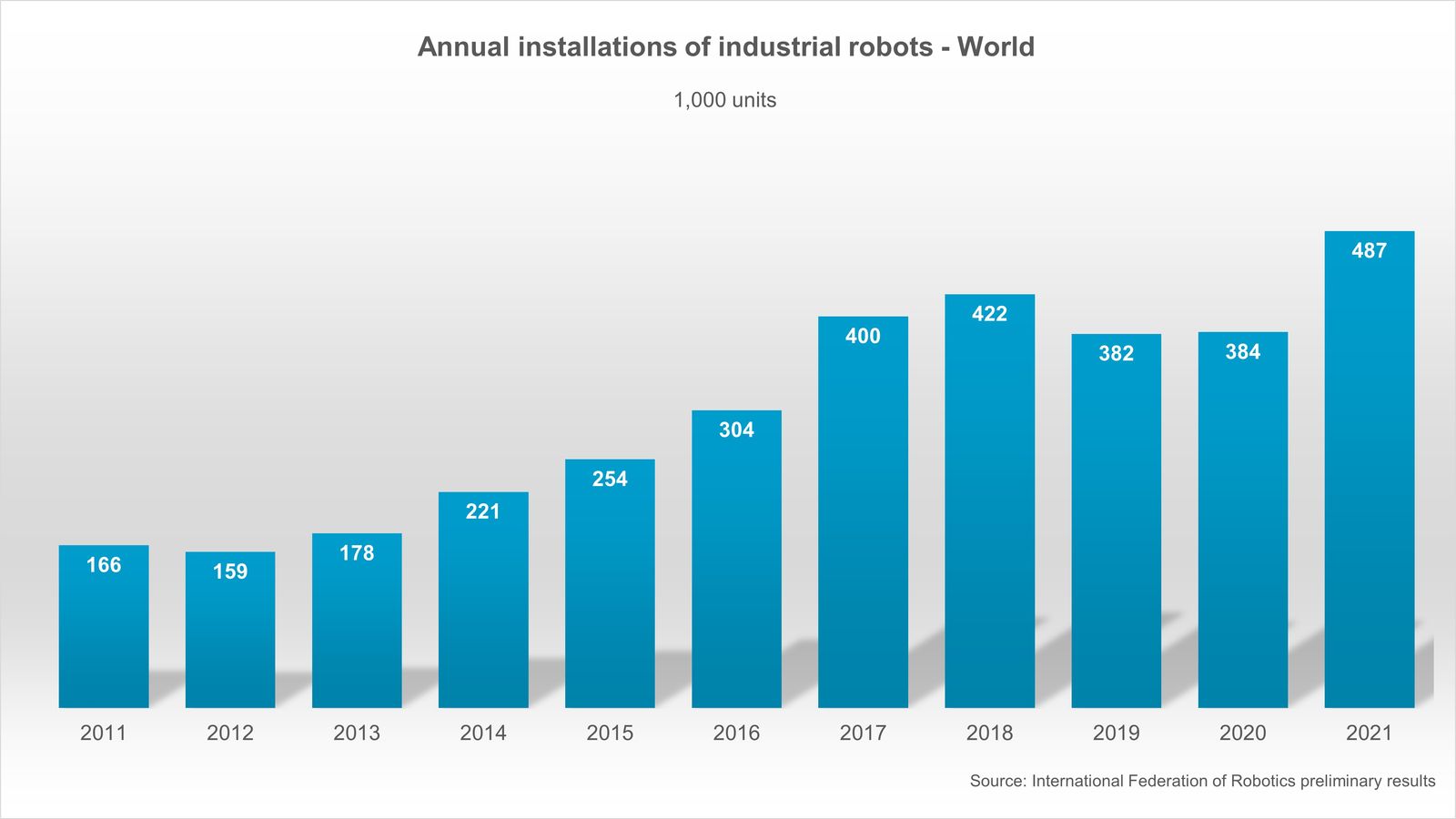

Revenue rose by 43% and reached a value of $664 million. These results are in line with a positive trend worldwide: Preliminary data for 2021 show, that 486,700 industrial robots have been installed globally (+27% year-on-year).

“A strong recovery of the international robotics markets is currently in progress: Worldwide installations of industrial robots in 2021 even exceed the record year 2018,” said Milton Guerry, president of the International Federation of Robotics (IFR). “In North America, first-quarter order volumes for both units and revenue were at all-time highs. Across industries, the post-COVID crisis boom creates double-digit growth over the same quarter of last year.”

Automotive orders up

In North America, car makers and manufacturers of components accounted for 47% of robot orders in Q1 2022, their orders grew by 15% year-on-year. Several car manufacturers have announced investments to further equip their factories for new electric drive car models or to increase capacity for battery production.

These major projects will continue to create demand for industrial robots in the next few years. The United States has the second largest production volume of cars and light vehicles in the world, following China. Worldwide installations of industrial robots in the automotive sector reached 109,400 units in 2021 (+37% year-on-year).

Non-automotive sectors surpassed automotive

Continuing a trend, non-automotive customers have ordered more robots than automotive customers. Worldwide, the electrical & electronics industry is the strongest adopter with a record of 132,200 units installed in 2021.

In North America, automotive customer orders in Q1 2022 were 5,476 units, while non-automotive customers ordered 6,122 units in the same period. In seven out of the last nine quarters, orders from non-automotive customers surpassed orders from automotive customers.

Related Glossary Terms

- recovery

recovery

Reduction or removal of workhardening effects, without motion of large-angle grain boundaries.

- robotics

robotics

Discipline involving self-actuating and self-operating devices. Robots frequently imitate human capabilities, including the ability to manipulate physical objects while evaluating and reacting appropriately to various stimuli. See industrial robot; robot.