Economic activity in the manufacturing sector contracted in December for the second consecutive month, while the overall economy grew for the 79th consecutive month, according to the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The report, issued Jan. 4 by Bradley J. Holcomb, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

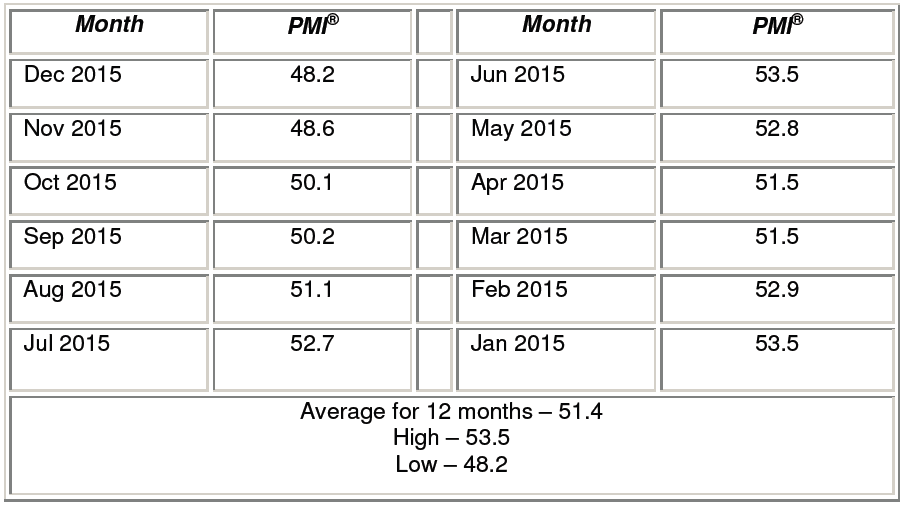

The PMI® readings over the past 12 months. Courtesy ISM®.

Here's how the various indices tracked by the report stacked up in December:

- The December PMI® registered 48.2 percent, a 0.4 percentage point decrease since the November reading of 48.6 percent.

- The New Orders Index registered 49.2 percent, a 0.3 percentage point increase since the reading of 48.9 percent in November.

- The Production Index registered 49.8 percent, a 0.6 percentage point more than the November reading of 49.2 percent.

- The Employment Index registered 48.1 percent, 3.2 percentage points below the November reading of 51.3 percent.

- The Prices Index registered 33.5 percent, a decrease of 2 percentage points from the November reading of 35.5 percent, indicating lower raw materials prices for the 14th consecutive month.

- The New Export Orders Index registered 51 percent, up 3.5 percentage points from the November reading of 47.5 percent.

- The Imports Index registered 45.5 percent, down 3.5 percentage points from the November reading of 49 percent.

"As was the case in November," according to the report, "10 out of 18 manufacturing industries reported contraction in December. Contraction in new orders, production, employment and raw materials inventories accounted for the overall softness in December.”

Of the 18 manufacturing industries, six reported growth in December—in the following order:

- Printing & Related Support Activities

- Textile Mills

- Paper Products

- Miscellaneous Manufacturing

- Chemical Products

- Food, Beverage & Tobacco Products.

The 10 industries reporting contraction in December—listed in order—are:

- Apparel, Leather & Allied Products

- Plastics & Rubber Products

- Machinery

- Primary Metals

- Fabricated Metal Products

- Transportation Equipment

- Electrical Equipment, Appliances & Components

- Computer & Electronic Products

- Wood Products

- Nonmetallic Mineral Products.