While data used to calculate the 2015 A.T. Kearney U.S. Reshoring Index contradicts reports of a reshoring trend for U.S. manufacturing, the index itself should not be construed as opposition to reshoring efforts, according to A.T. Kearney, the Chicago-based global management consulting firm that publishes the index.

"To be clear, we do not take a position for or against reshoring," according to a written statement from Patrick Van den Bossche, an A.T. Kearney partner and co-author of the firm's 2015 Reshoring Index. He issued the statement today in response to comments critical of the index submitted by Harry Moser, the founder and president of the Reshoring Initiative, an industry-led group out to prove offshoring is not always the best economical decision for companies.

Moser's comments, posted here Jan. 25, suggested that A.T. Kearney's index was wrong, misleading and an attempt to gain attention.

Van den Bossche noted, however, that A.T. Kearney's methodology for calculating the index results in a much more accurate reflection of the reshoring story. "We simply analyze publicly available government data to find out what actually happened, instead of relying on surveys," which, he added, have repeatedly proven to be overly optimistic.

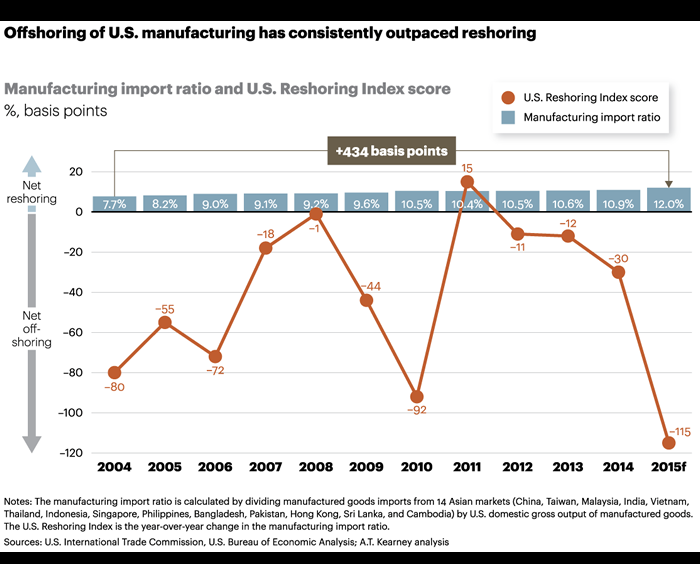

What A.T. Kearney found was a 2015 U.S. Reshoring Index of –115, which represents the year-over-year change in the manufacturing-import ratio. A negative value indicates net offshoring.

While Moser said A.T. Kearney correctly reported that foreign direct investment (FDI) in 2015 was stronger than reshoring, the Reshoring Initiative considers FDI and reshoring to be part of the same phenomenon. "In both cases," Moser said, "the company decides it is more profitable to serve the U.S. market from a U.S. based factory instead of from a foreign factory."

On this point, Van den Bossche reiterated that A.T. Kearney's U.S. Reshoring Index focuses exclusively on reshoring of U.S. manufacturing back to the United States, not FDI by foreign companies. "This is because there are crucial differences in the underlying dynamics of reshoring and FDI," said Van den Bossche, "and we believe that the distinction needs to be maintained to get a true picture of decisions made by non-U.S. and U.S. companies.

"For example," he continued, "the Brookings Institution now estimates that one in every five U.S. manufacturing jobs is with foreign-owned companies. That’s roughly 2.4 million jobs, up from 1.6 million in 2012. So, while overall employment in U.S. manufacturing has only increased by a few percentage [points] over the that same period, foreign-owned companies have increased their U.S. manufacturing jobs significantly by about 50 percent—in part by buying U.S. companies and, increasingly, by expanding or building greenfield manufacturing operations."

Van den Bossche also shared a LinkedIn post by Yossi Sheffi, director of the Massachusetts Institute of Technology's Center for Transportation and Logistics, for anyone grappling with the seemingly conflicting reshoring reports.

Related posts:

- Read more about the A.T. Kearney Reshoring Index.

- Reshoring Initiative offers rebuttal to A.T. Kearney reshoring analysis.