Global machinery production revenue to reach $1.6 trillion in 2022

Global machinery production revenue to reach $1.6 trillion in 2022

The market performance of the machine tool sector is highly dependent on commodity prices, macroeconomic conditions and sector performance (e.g., automotive, construction, aerospace, and ship building). According to IHS Markit Economy and Country Risk (ECR) information, a global recession is highly unlikely to occur in 2019. However, due to weaker global trade, pollical uncertainties, and other headwinds, global machine tools production revenue will only begin to improve late in 2020 or early in 2021.

By Teik Chuan Goh, analyst, manufacturing technology, IHS Markit

Highlights:

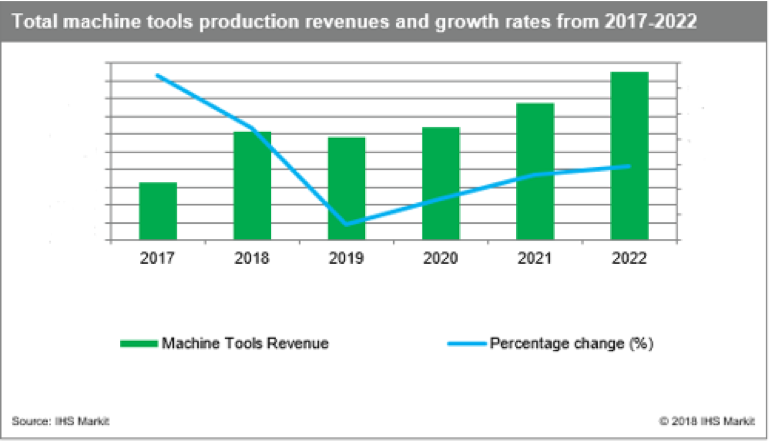

- 2019 will be a tough year for machine builders, with overall global machine production revenue growing at a compound annual growth rate (CAGR) of 2.1 percent from 2017 and reaching $1.6 trillion in 2022.

- Year-over-year eurozone machine production revenues are expected to contract slightly by 0.4 percent in 2019. The Asia-Pacific region will grow by low single digits, as growth in China – the largest contributor in the machine tools market – is expected to remain in the single digits, at least until 2020.

- The machine tools category comprised 5.7 percent of all global machinery production revenue in 2019. After the global economic downturn in 2015, a short 5.5 percent year-over-year growth spurt in 2017 helped revenues climb to their highest level. However, the year-over-year growth rate fell to 3.4 percent in 2018. It is expected to decline by 0.4 percent in 2019.

- The largest downstream industries in the machine tool sector are automotive, with 25 percent of revenues, and consumer electronics, with 16 percent.

Analysis:

The market performance of the machine tool sector is highly dependent on commodity prices, macroeconomic conditions and sector performance (e.g., automotive, construction, aerospace, and ship building). According to IHS Markit Economy and Country Risk (ECR) information, a global recession is highly unlikely to occur in 2019. However, due to weaker global trade, pollical uncertainties, and other headwinds, global machine tools production revenue will only begin to improve late in 2020 or early in 2021.

Automotive and consumer electronics lead the market

The poor sales of automobiles in late 2018, and the downward-trending market for smartphones and PCs, is reflected in the latest sales and production revenue estimates from IHS Markit. Other broad, underlying factors for the downturn include a weaker global trade environment, increased geopolitical tensions, lower investor confidence and declining global vehicle sales. Furthermore, the top producing and consuming countries for this type of machinery – namely, Germany and China – have been hit especially hard by the industry downturn.

Bleak near-term signs for machine tools production in Germany and China

In the fourth quarter of 2018, Germany's manufacturing purchasing managers index (PMI) slipped to a 31-month low. The country's total machinery production revenue is forecast to contract by 0.3 percent in 2019, with machine tools revenue growing at just 0.7 percent, year over year. Germany's poor performance was caused by the global decline in automotive manufacturing. While it is difficult to isolate the main reason for the declining growth in this industry, changes in the way new vehicles are regulated is an obvious candidate.

The tedious and long approval time for regulatory compliance has proven costly to automakers. Especially in Europe, consumers are also more conscious about making new vehicle purchases, in the face of these ever-changing regulations. Although the automobile manufacturing industry has made strides in implementing new technologies, market conditions will continue to push near-term machinery investment rate to an all-time low.

Machinery production in China is also facing tremendous downward pressure, due to slowing investment, sluggish growth in downstream industries and the Sino-US trade war. China is also dealing with many of the same problems Germany is facing, including contracting automotive sales and weaker global trade.

Although national stimulus policies have been enacted, and industrial upgrades have been implemented gradually, they have not done enough to offset the economic headwinds in China. IHS Markit forecasts that China's machinery production revenue will grow only 1.4 percent in 2019, the lowest rate since 2015. Machine tools production revenue will also suffer, contracting by 3.7 percent in 2019.

Timing is key for AGVs and AI and other game-changing innovations

Good timing is often the key to a successful product launch. Despite the current declining economic conditions, the application of automated guided vehicles (AGVs) and AI in machine tools is expected to increase in the next few years. Some companies are more keen than others to strengthen their competitive edge during hard times.

Machine tool companies have started to include AGVs in their work flows, to load and unload materials. Normally this process would be handled by a few skilled workers, but this type of work can now be completed by a single AGV with a robotic arm.

Robotic modules with robotic arms are also used to help cutting machines load, unload and move products and manufacturing components. Hybrid solutions are now appearing, that enable machines to form and cut at the same time. This ability is particularly important for production lines that need to save space, by minimizing the machine footprint.

With efficiency and precision in mind, proprietary AI systems can be used to constantly tune and optimize cutting machines in real time and without human intervention. These systems are smart enough to regulate cooling and power, which results in cost savings from less waste material, longer service intervals and reduced power usage. On top of all of that, cutting tools can be continuously tuned and adjusted to provide an optimal cut.