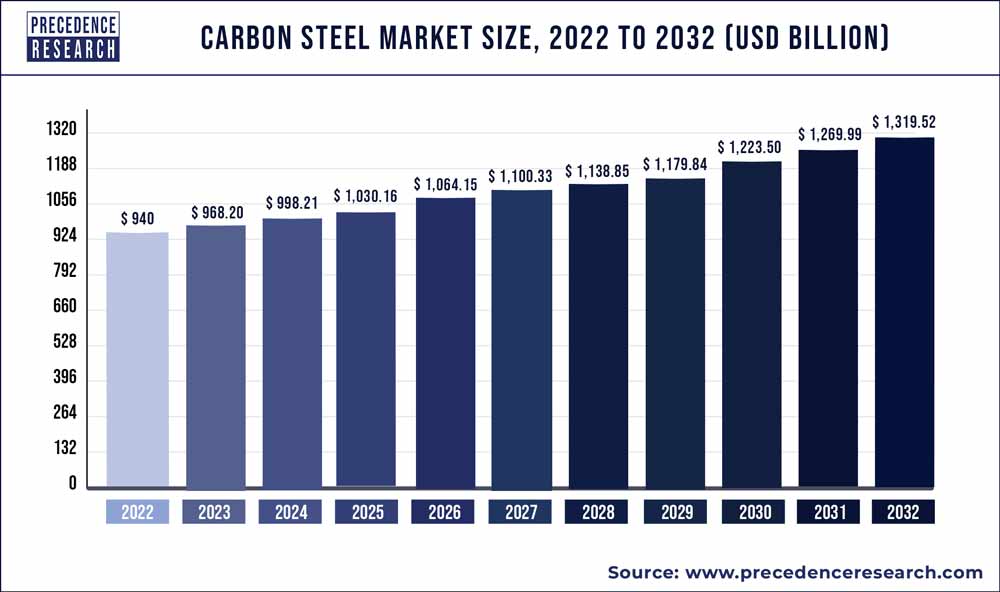

The global carbon steel market size is anticipated to reach $1.2 trillion by 2030 at a CAGR of 3.72%, according to a new report.

According to Straits Research, carbon steel has at least 2.1% carbon. Low-, medium-, and high-carbon steel are varieties of carbon steel. High ductility and low cost make them perfect for machining and welding.

Key drivers

The building business must retain stability despite market challenges. In the current environment, investments in carbon steel infrastructure are rising. Construction projects in India and ASEAN are anticipated to fuel consistent demand for building supplies such as beams, angles, wire rods, and bars, which are anticipated to accelerate market expansion.

Repair and rehabilitation are anticipated to make up a significant portion of overall costs, with a major portion of demand coming from carbon steel products. To meet the rising demand and reduce emissions for longer-term sustainability, various producers will concentrate on recycling carbon steel in the following years.

Demand for carbon steel is increasing due to the global automotive industry's consistent growth, which is also a significant driver of market revenue expansion. The automotive industry uses high-carbon carbon steel that has been quenched during a heat-treatment process to boost its durability. Compared to Advanced High Strength Steel, High Carbon Steel is less ductile and more prone to brittleness (AHSS). But because these steels are abrasion-resistant, they are also employed in producing tools and metal fasteners, among other things. These are employed in producing door panels, bushings, door frames, chassis, and several other parts for the automotive industry. SAIL TMT bars also employ high-carbon steel.

Growth opportunities

The governments of developing countries are adopting and carrying out plans and actions to develop infrastructure. The government continually makes investments in research and development projects to build infrastructure. In industrialized nations, including North America, Europe, and Asia-Pacific, infrastructure expansion has raised the demand for carbon steel.

Government funding is provided for infrastructure development projects to promote economic growth. These initiatives raise market demand for carbon steel. As a result, the market for carbon steel is expected to grow profitably during the forecast period due to the increased focus on infrastructure construction.

Regional analysis

The global carbon steel market is divided into Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia-Pacific will have the most significant market share due to its robust shipbuilding industry. China's shipbuilding sector held 48.4% of the global shipbuilding market revenue in 2021 based on deadweight. In 2021, 52% of global orders were newly received, and 48.1% were hand-placed. Since 2010, the Philippines has become a significant shipbuilding hub, ranking fourth globally. Increasing shipbuilding in the region drives carbon steel demand, boosting market revenue.

North America is predicted to have the fastest CAGR due to the growing demand for carbon steel and the construction industry. In 2021, U.S. construction revenue was $1.589 trillion. Construction employed roughly 7.5 million people in January 2022 or 4.8% of the U.S. workforce. Construction contributes 4.3% of the U.S. GDP. Increasing construction in the region drives market revenue growth.

According to the research, the construction segment is expected to contribute the most to the global market during the estimated period.

The global market for carbon steel is divided into three parts based on type, application, and region. Further, based on type, the market is broken down into High Carbon Steel, Medium Carbon Steel, and Low Carbon Steel. The low-carbon steel segment will dominate the global market during the estimated period.

The market is broken down into Asia-Pacific, Europe, North America, Latin America, and the Middle East & Africa. The Asia-Pacific region dominated the market in terms of revenue share.

Recent developments

Some key players contributing majorly to the global carbon steel market are JFE Steel Corporation, Nippon Steel Corporation, POSCO, AK Steel International B.V., United States Steel Corporation, EVRAZ plc, Baosteel Group, NLMK, ArcelorMittal, and HBIS Group.

- In April 2022, one of the world's leading mineral resource corporations and Nippon Steel Corporation inked an MoU to deepen their partnership and evaluate and discuss particular solutions to achieve carbon-neutral steelmaking processes.

- In June 2022, new test facilities will be built for two research and development projects to develop methods to utilize carbon in steelmaking processes to become carbon neutral by 2050 by JFE Steel Corporation.

- In February 2022, U.S. Steel constructed an advanced steel facility in Arkansas designed to be environmentally friendly.

Related Glossary Terms

- ductility

ductility

Ability of a material to be bent, formed or stretched without rupturing. Measured by elongation or reduction of area in a tensile test or by other means.