Significant growth is occurring in practically every U.S. manufacturing sector, including automotive, electronics and general industry, according to Gustavo Sepulveda, robotics and business automation head at Panasonic Connect North America in Hoffman Estates, Illinois. “I have not seen, in the last 25 years, a better moment to be in manufacturing.”

One prominent reason is more nearshoring, he added, as U.S. companies want manufacturing to take place as close as economically possible to minimize any future potential risk, such as another pandemic or logistic snags that cause a lack of components. Sepulveda’s area of expertise is helping to overcome the latter now and in the longer term. “Because companies need to grow, and due to the lack of personnel, they are automating more and more.”

The automation initiatives involve equipment and programming purchases, Sepulveda said. “I see a very strong marriage between hardware and software, and you do not see anyone buying hardware without buying software and vice versa.”

As manufacturers grow along with their automation footprints, Sepulveda emphasized that robots and other labor-saving automation equipment is not enough to maintain that development — more human workers are required.

“There is the myth that automation eliminates jobs. It is exactly the opposite,” he said, adding that automation also improves worker safety and part quality, and generates more revenue. “If you see the countries in the world with the lowest unemployment rates, what a coincidence that those countries have the highest density of robots.”

Machine Movement

One sector that is experiencing slower output and a decline in new orders this year compared to 2022 is machine tools, said Director of U.S. Industries Mark Killion, a chartered

financial analyst at Oxford Economics USA Inc. in Wayne, Pennsylvania. But that situation is not necessarily negative because machine tool builders were trying to catch up in the previous year as customers placed a lot of new orders to deal with their own issues, such as supply chain snarls.

“It has been a transition year this year for the machine tool industry,” Killion said. “This year things have calmed down a bit. It’s allowed the industry to stabilize inventory levels a bit and to have the high backlog of orders that were in place previously to be worked off.”

One trend, he noted, is that the average cost of a machine tool has increased during the past few years, which reflects the extra value-added features many machines offer to help overcome ongoing labor challenges.

“It is one of the reasons why there is a greater demand on the part of many customers for productivity-enhancing features, such as software and connectivity,” Killion said. “Trying to keep up the output with the same amount or even a smaller amount of workers is something that a lot of manufacturers are facing — not by choice but out of necessity.”

In addition to enhancing machinery, manufacturers are upgrading the skills of their workforces — upskilling, Sepulveda said. For example, workers who were just moving workpieces from one cell to another are now being trained to program robots that will move the pieces instead. “A lot of our customers are asking us to have a permanent trainer because they want to upskill all their personnel.”

Up in the Air

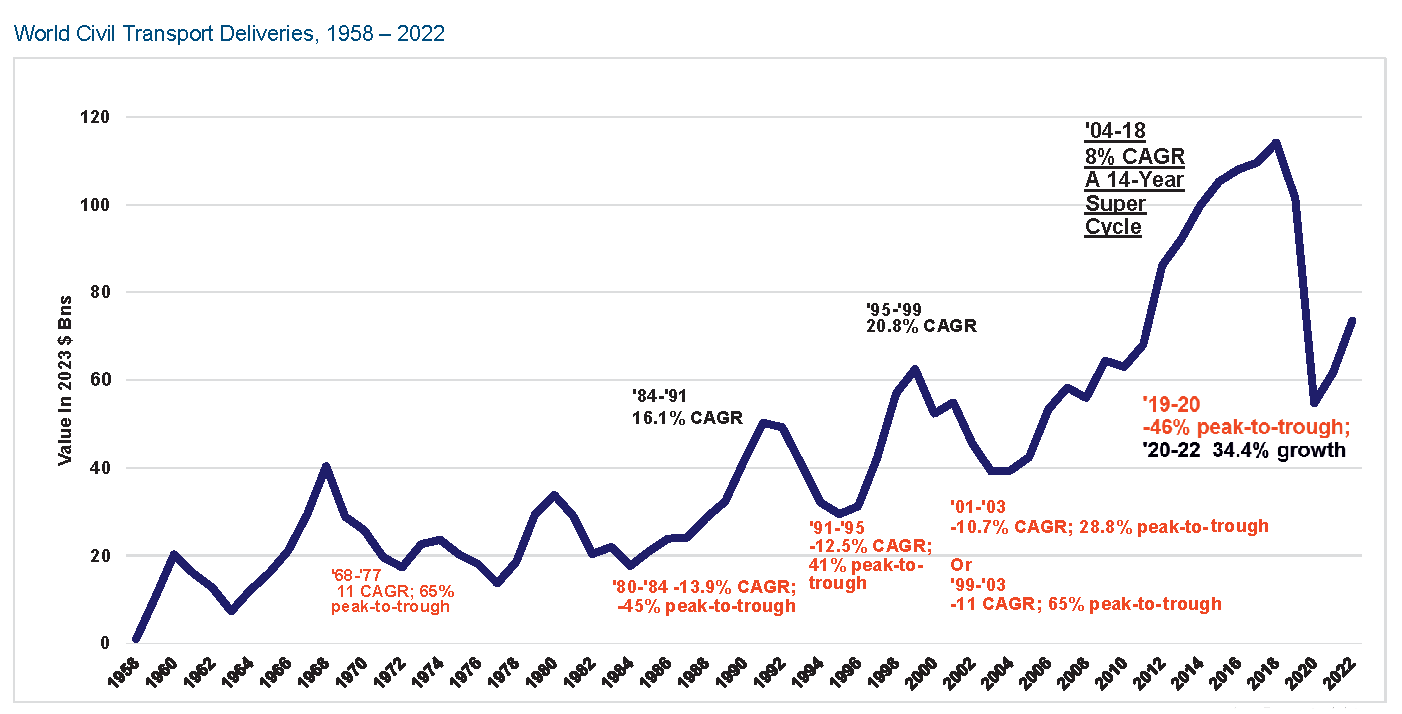

The aerospace environment is also changing as the industry’s supply chain faces numerous bottlenecks, with labor on top, according to Richard Aboulafia, managing director of AeroDynamic Advisory LLC headquartered in Ann Arbor, Michigan. Other shortages include microchips, forgings, chemicals and resins, castings, machined parts, and supplies of superalloys and titanium mill product and sponge.

“This is the first time in my 35 years where the demand side doesn’t matter very much,” he said. “It’s supply-side challenges. Thought I’d never see that. I look at markets, markets and markets, and all of a sudden for the first time it’s really the production side that is having issues.”

Compounding the worker shortage for commercial aviation is that the defense side is competing for the same technical skills and their bait is generally more enticing, Aboulafia said. “With defense being as high as it is, and defense spending usually more of a cost-plus business where you don’t have to worry about how much you pay them, getting talent in the commercial side just is an ongoing challenge.”

Another concern is the new generation of single-aisle engines. “There are only two new-generation single-aisle engines,” he said. “Both have had problems, a bunch of problems.”

The latest one was the recall by Airbus supplier RTX of 1,200 Geared Turbofan engines built by its Pratt & Whitney subsidiary, which was prompted by microscopic contamination in the powdered metal used to make high-pressure turbine discs for engines, leading to a risk of microcrack accumulation.

Aboulafia noted that the new-generation engines require more maintenance because of the engines’ higher performance levels, higher operating temperatures and higher pressures. “A lot of them were sold with guaranteed cost agreements, sort of power-by-the-hour type contracts, so there could be a hit to engine makers’ profitability in some cases.”

Nonetheless, with supply side challenges for the industry, older engines and other equipment needs to remain in service longer, he said. “It’s a growing concern because it’s pretty labor-intensive and labor is the heart of the problem here. On top of that, you had an awful lot of people deferring maintenance during the pandemic, nonessential maintenance, so that is all coming due. It’s creating a bit of an MRO super cycle — a huge challenge.”

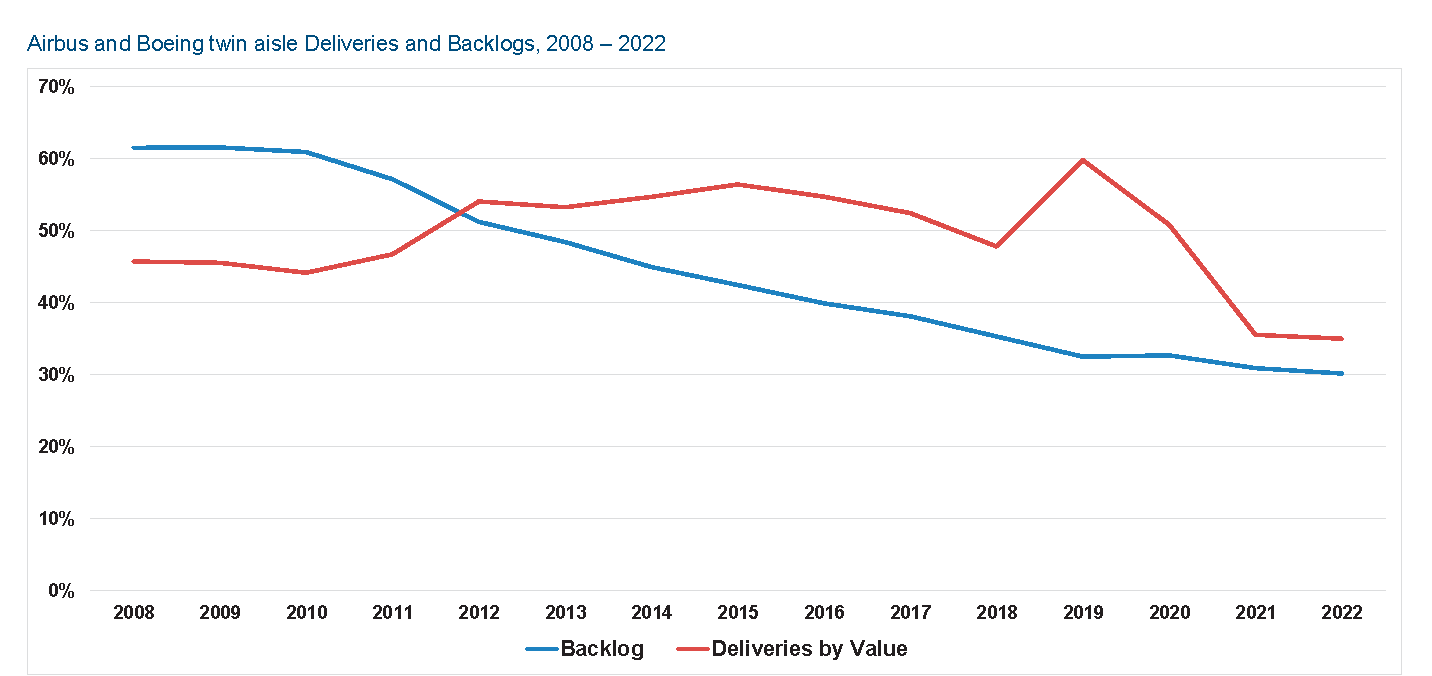

One big trend that continues is the shift from twin- to single-aisle airplanes, Aboulafia noted, as the backlog and deliveries by value for both Airbus and Boeing twin-aisle offerings were at their lowest levels in 2022. Single-aisle planes can travel increasingly longer distances, “doing routinely 3,000 to 4,000 nautical mile routes. The real power of this is when the A321XLR version shows up in about a year or so. That’ll do north of 4,000 nautical miles.”

He added that the trend is positive news for the metal side of the aerospace industry because single-row planes are mostly made of metal while the two most popular twin-aisle jets are comprised of about 50% components.

Coming down the tarmac is the possibility that another airplane style — the blended wing body — will take to the skies as the industry seeks to significantly reduce carbon emissions. A blended wing airframe is projected to reduce fuel burn and emissions by 50%. “I’m a huge fan,” Aboulafia said. “It’s going to be a long road to get there, but in terms of a potentially transformational new technology, the blended wing body is the best we’ve seen in many, many years.”

He added that the Air Force gave Northrup Grumman a contract to build a prototype for an aircraft that’s designed and built with its body integrated with the wings. “It looks extremely promising. It’s not just a tube that flies through the air. It’s not just a weight with drag. It’s also something that provides additional lift. Now from a seating standpoint, more people are going to have to learn to live without looking out of windows I’m afraid, but the economics are going to be much better.”

Building Bridges

Economic gains also occur when manufacturers overcome the skills gap and have enough proficient workers to fulfill their needs, Panasonic Connect’s Gustavo noted. “So, companies are providing a lot of training, and employees who are trained are more likely to stay in a company because they see themselves growing and being capable of a lot of things that they were not doing before.”

He added that some manufacturers are hesitant to train employees because they fear they will take their newly gained skills to greener pastures. While Gustavo acknowledges that a small number go that route, he said the vast majority instead stay to help take a company to the next level. “Companies that provide this training, I can almost guarantee you, they will more likely retain people than the ones that do not provide any training.”

In addition to in-house training, Gustavo said Panasonic Connect partners with various schools in which the company provides equipment so students can learn its technology. “When they leave, they already know the Panasonic technology, which is a great advantage first of all for the students, second for the companies that will hire them, and third for Panasonic.”

As an example, Lorain County Community College in Elyria, Ohio, entered a collaboration with Panasonic Connect to help develop the next generation of manufacturing professionals. Panasonic reports that as part of the partnership, LCCC chose the company’s SPG screen printer and NPM-W2 placement platform to use in the school’s lab for hands-on training. So far, 100% of graduates have been hired into the industry.

The future is uncertain, but manufacturers need to plan their steps forward with risk and scenario analysis, according to Oxford Economics’ Killion. “I like to be on the lookout for signposts along the way to indicate whether it’ll end up going down one road versus another and then being able to react pretty quickly to that.”

Helping to spot signposts by engaging in robust scenario planning can help manage operations when aligned with greater connectivity within a production facility, ever-larger big data sets and enhanced machine learning, he said.

These types of initiatives should yield tangible benefits, Killion added. “You’ll see it in terms of movement in a lot of industries for higher profit margins and high productivity, being able to just produce more with less amount of manpower and materials.”

Taking a Breather

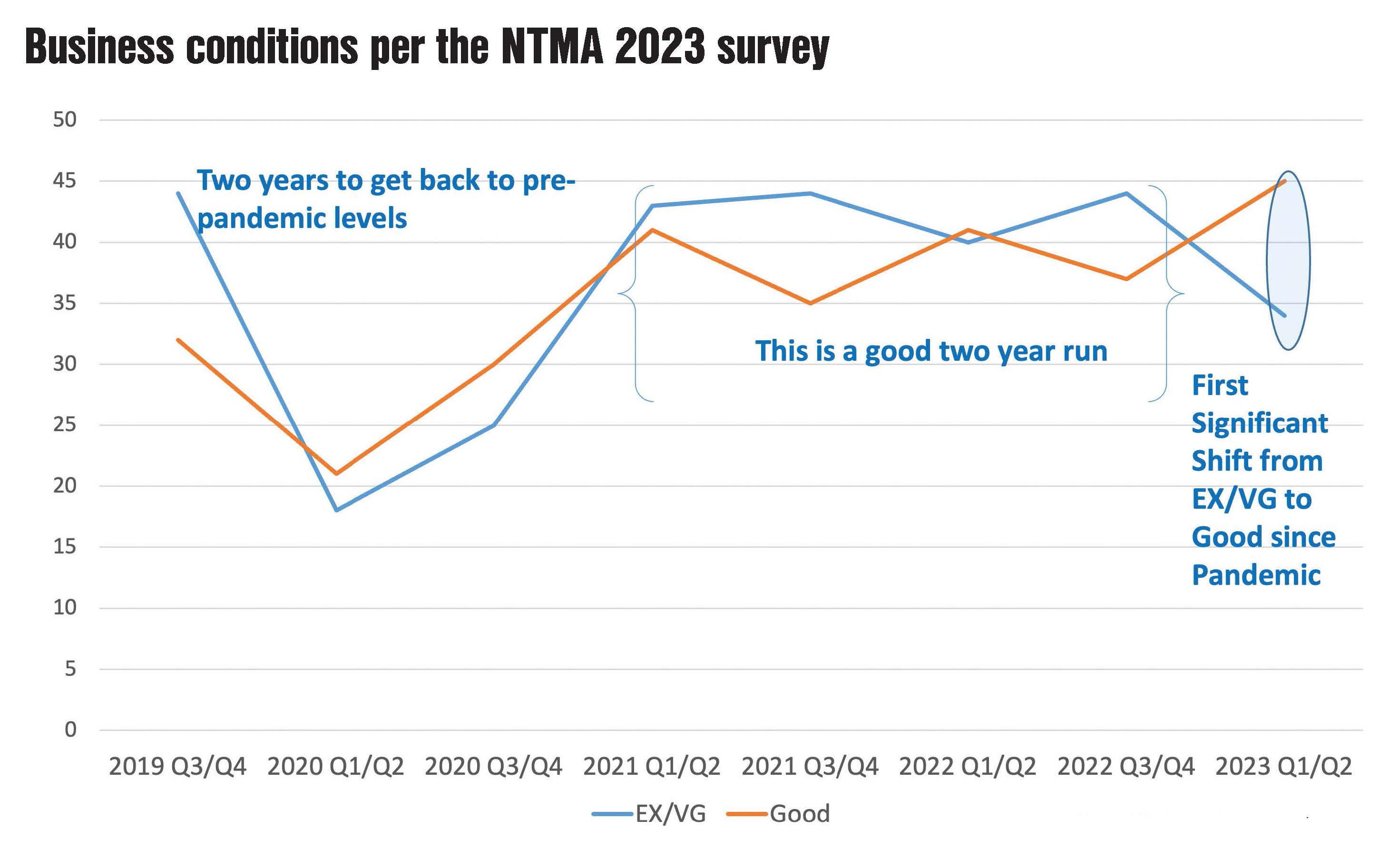

Similar to machine tool builders, job shops and contract manufacturers are seeing the strong growth experienced over the past two years flattening or slowing, said Roger Atkins, president of the National Tooling and Machining Association, based on surveys of the members of the Cleveland-based association. “Most people are thinking it’s going to be close to the same, with very few predicting too much of a downturn.”

After somewhat catching up to the pent-up demand caused by supply and other disruptions during the height of COVID, Atkins added that most shops have backlogs at pre-pandemic levels. “We’ve been on a good two-year run. It does give you the chance to catch your breath a little.”

Nonetheless, NTMA members are typically still working the same number of hours a week, with many experiencing 12% to 16% annual growth while continuing to invest in capital equipment, Atkins said. “Small and medium-sized manufacturers have purchased over 50% of the new equipment. We’re 50% of the buying community for new machine tools.”

When reshoring and near-shoring, Atkins emphasized that shops must reduce their costs eventually by 15% to 20%. In addition to capital equipment, the other major expenses are labor, raw materials and tooling. “There’s not a lot you can do on labor, so productivity and efficiency gains must come from capital expenditures, automation, tooling and raw materials.”

Not only is the cost of labor expected to rise, Atkins noted, but recruiting and retaining workers will remain ongoing challenges. “You’ve got to tell your story and make sure people understand the impact they’re having on our nation’s economy by the parts that they make.”

He added that shops should also tell the message of how the parts they produce go into end products that improve people’s lives by, for example, making air travel and medical surgeries relatively safe and common. “None of these can happen if not for small- and medium-sized manufacturers across the United States making these parts.”

If a parts manufacturer is struggling with recruiting employees, options exist. “If you’re not getting new people,” Atkins said, “you better be upskilling your current employees, trying to help them upskill what their capabilities are in your shop.”

In addition, automation can have a positive impact, but not by reducing head count, he noted. “It’s just doing more work with the same number of employees you got.”

However, about two-thirds of NTMA members are not considering acquiring robots in the next six months, according to a recent survey. “That number has been consistent,” Atkins said. “If you’re a high-mix, low-volume manufacturer, it’s hard to think robotics.”

But they should, he added, especially when hiring hits a wall. After buying a robotic arm for one application, workers usually determine more and more areas where it can be used.

But if that scenario is not a good match, other types of equipment can be considered to make setups quicker and easier, or maybe a larger tool carousel is needed to enhance operations, Atkins added. “Robotics is not the only part of automation.” —Alan Richter

For more information about the National Tooling and Machining Association, call 800-248-6862 or visit www.ntma.org.

Related Glossary Terms

- arbor

arbor

Shaft used for rotary support in machining applications. In grinding, the spindle for mounting the wheel; in milling and other cutting operations, the shaft for mounting the cutter.

- milling machine ( mill)

milling machine ( mill)

Runs endmills and arbor-mounted milling cutters. Features include a head with a spindle that drives the cutters; a column, knee and table that provide motion in the three Cartesian axes; and a base that supports the components and houses the cutting-fluid pump and reservoir. The work is mounted on the table and fed into the rotating cutter or endmill to accomplish the milling steps; vertical milling machines also feed endmills into the work by means of a spindle-mounted quill. Models range from small manual machines to big bed-type and duplex mills. All take one of three basic forms: vertical, horizontal or convertible horizontal/vertical. Vertical machines may be knee-type (the table is mounted on a knee that can be elevated) or bed-type (the table is securely supported and only moves horizontally). In general, horizontal machines are bigger and more powerful, while vertical machines are lighter but more versatile and easier to set up and operate.

- robotics

robotics

Discipline involving self-actuating and self-operating devices. Robots frequently imitate human capabilities, including the ability to manipulate physical objects while evaluating and reacting appropriately to various stimuli. See industrial robot; robot.

- sponge

sponge

Form of metal characterized by a porous condition that is the result of the decomposition or reduction of a compound without fusion. The term is applied to forms of iron, titanium, zirconium, uranium, plutonium and the platinum group metals.

- superalloys

superalloys

Tough, difficult-to-machine alloys; includes Hastelloy, Inconel and Monel. Many are nickel-base metals.

Contributors

AeroDynamic Advisory LLC

734-773-3899

www.aerodynamicadvisory.com

Oxford Economics USA Inc.

646-786-1879

www.oxfordeconomics.com

Panasonic Connect North America

https://na.panasonic.com/us/factory-equipment-solutions/smart-manufacturing-solution/factory-automation-solutions